Is this the Right Time to Buy Property?

- By Admin

- User Guide

In the age of mass communication Word spreads like wildfire; thanks to the most attentive readers and viewers of news and article, tittle-tattle is the most underhanded in influencing view. A lot has been examined and even more has been presented about the impact of currency Demonetization on Real Estate Sector.

As we know, real estate sector is a major contributor to India’s GDP approx 9 percent, Real estate, an overall contributor of 9 percent to India’s GDP, and a big capital-intensive sector in our country, has been the top of apprehension for investors and end users, when currency demonetization was executed a few days ago. Long queues at the front of the banks & ATMs, waiting for the cash, withdrawals and exchange the currency are now a common view in India.

The main objective behind this step by Central Government was to stop the flow of Black Money, and it is not a big problem for the affordable & mid-range residential projects in India. Residential projects that bring value for money, and always performed basic and accountable financial transactions during the sale, would not be affected. High value Residential Projects (Rs. 2 Crore and above) in small towns would be affected because of heavy cash transactions. Now Real estate Developers know that as long as payments are done in transparently, the value of the properties would not be affected, and fresh sales of such residential projects will definitely not be disturb.

Industry experts have a common belief that this step will perform well for the realty market in the long time span. This step is a great optimistic step for the Indian real estate, the results of which are estimated to be far reaching and instant. At the same time as this unexpected termination of higher currency notes will shake up the sector in a big way, it in unquestionably a right step on the right track.

Why is this the Best time to Buy Residential Property?

Last step of the Corruption in Real Estate

The major advantage of the demonetization of 500 - 1000 Notes is that it will reduce black money to a large extent in the country. By stopping the flow of black money into realty sector, this step will defeat the corruption. The real estate deals which went unregistered because of being dealt with in hard cash will now come under the IT Department’s scanner. Strict guidelines will help ensure that corruption remains controlled in the long term as well.

Improved Transparency

The effect of this currency demonetization is expected to be vast in the field where cash payment is the standard. This step will encourage cashless economy and as a result will bring transparency in the sector, particularly in the purchase of plots.

It will as well put a tight surveillance on the forged real estate developers and the unreliable players who tend to fool people by unregistered transactions. This is ready to work together with the other steps being taken by the Central Government like RERA guidelines and will undoubtedly help the transparency of real estate.

Better Foreign Investment

High transparency in real estate and an optimistic attitude of the Indian Government about policy reorganizations will play a big role in magnetize more & more foreign investment into this field.

Genuine price points

Last but major impact of this step will be a sliding push on residential projects, including plots. This initiates from the probability that buyer will now be unable to install their black money in property, which in line will compel builders to set as much as lower prices. According to the real estate experts the price adjustments of about 10 – 30 percent may take place depending on the location. The deflationary force generally and more specifically on property price will be an advantage for affordable home seekers.

At this time the current market opinion might be a little doubtful because of the unexpectedness of this step, experts are positive that the future holds great potential for the Real Estate.

Related More Blogs

TARC Tripundra: Live In The Heart Of Delhi

Project ReviewsTARC Tripundra apartments are smartly planned in the best part of Delhi city- Main Bijwasan Road....

Affordable Housing in India – A Complete Insight

Market TrendsAffordable homes in India are undoubtedly one of the biggest contributors to the total demand for...

Rising A New Hope for the 50, 000 Home Buyers in Noida & Greater Noida

NewsAs confirmed by a source “Central Government is going to shrink the area around the Okhla Bird Sa...

Latest Projects In Gurgaon - Which Are Blessed With Immense Benefits

Project ReviewsEverything you need to know about what all new projects are available in Gurgaon which is known a...

Important Tips for Buying Green Homes in India

User GuideThe fantastic pace of real estate development all over the world, and particularly young, develop...

Experion Developers. - Investment of Rs 175 crore for commercial project

NewsThe another spinning step by Experion Developers to develop futuristic commercial space in Gurgao...

Tata Housing About to Showcase New Projects in Eight Cities

NewsTata Housing Company form October 26-28 with the price tag Rs 29 lakh and Rs 50 lakh. After deliv...

Tata Housing puts Another Luxury Segment in Top Cities with the Budget of Rs 3,200 Cr

NewsTata Housing appetite is not yet over, that’s why they are coming up with high profile properties...

Tata Housing Ready to Spread out their Footprints in Dubai with Valuable Office Space

NewsTo expand the range of work Tata Housing increase its presence and put his foots in Dubai to open...

Investment of $2 billion in Dubai Real estate by Indians

NewsIndians maintained the level of investment and it is been like this from several of years so for ...

Tata Housing Sold 250 Flats in Goa Through Facebook

NewsTata housing project in Goa has shown the real excitement and charm among the investors and home ...

Raheja to Bring New Light to Realty Market by Reducing Price to Rs 2500/sqft

NewsTo shake the real estate market, Raheja Developer today has taken a step to cut the price range o...

Godrej Properties Honored with AA Rating by ICRA

NewsGodrej Group garnered another vital AA rating by ICRA for (LOC) line of Credit. The rating commit...

Gurgaon-Sohna Road : With Unbeatable Projects For Strong Investment

NewsIts unveiled Gurgaon-Sohna Road is one of the sterling sites of Gurgaon for real estate sector wh...

Fresh FDI Norms to Push Affordable Housing Segment

NewsReal estate industry appealed government to relax FDI norms to fillip the foreign investment into...

Rapid Transportation in Gurgaon to Connect in a Better Way

NewsThe prime real estate bodies have compelled an appeal to transport department of Haryana to provi...

Another Hit by Sobha ltd to Build-Up Project in Gurgaon at Rs 1,000 Crore

NewsSobha ltd Bengaluru based Realty Company has passionately heighten the future building and makes ...

Vipul Developments Where Every Facility Surpasses

Project ReviewsVipul Group gives real estate of Delhi NCR a new frame. Motivated by its customer centric approac...

Latest Update on Constructions of DLF The Crest

Project ReviewsDLF The Crest, Gurgaon sector 54, sterling housing development is in its endmost development stag...

Tata Primanti Construction Streamline

Project ReviewsWorld’s prime reputed residential project “Tata Primanti Gurgaon” comes to its closing where they...

ILD Developers Setting Benchmark in Real Estate Industry in the Booming City Gurgaon

Project ReviewsAs with the passing time, Gurgaon is changing its face like a streak. Formerly known as Guru-gram...

First Know Gurgaon Better and then Invest

Project ReviewsGurgaon is the new face of India simply because of the plethora of modifications in the both resi...

Godrej Summit : Discover The Prime Housing Project of Gurgaon

Project ReviewsGurgaon today with gazillions of options that comes with commercial, business, residential, enter...

Know More about Top Indian Real Estate Builders

Market TrendsWho is a builder? The one who can replace dream into reality and above that, the one who has a ha...

Supertech Realty Next to Conceptualized 175 acres Township in Noida

NewsSupertech realty firm next coming with “sport-centric” township outspread over 175 acres of land ...

Singapore's Sovereign Wealth Fund GIC Funded in the Upcoming Projects of DLF in New Delhi

NewsMajor realty develop DLF said DLF Urban Pvt Ltd and DLF Midtown Pvt Ltd ceased to be its subsidi...

Positive Reasons for Investing in Commercial Properties Gurgaon

Project ReviewsIndividuals who are looking for real estate investment, commercial property in Gurgaon is best op...

20 Plus Factors for Investment in Real Estate Property

User GuideSee with many important things in life one thing is essential and that is investment in property,...

Sobha Developer Completed its Sale of Rs 478.30 Crore in the December Quarter

News2015 year was quite happy for the reputed real estate firm Sobha ltd as they sold out more than 8...

Top Properties in India to Enjoy Standard Living

Project ReviewsDespite the fact that Indian real estate market shows up and down but the presence of projects ar...

Top 3 Commercial Properties With Enjoyable Returns

Project ReviewsNow support of Government where recent bill was revised in order to bring more transparency in th...

Puri Constructions - New Commitments and Highest Ethical Practices

Project ReviewsLet’s just keep it very simply. Today there are mammoth different builders in the real estate mar...

Why Ready To Move Projects are Best Options for Home Seekers

Project ReviewsDecision of buying a home can be very easy, but lots of choices gives us dilemma condition....

E Commerce Websites help Real Estate in Boosting Sales

Market TrendsThe trend of approaching online real estate developments’ sales is catching up. Starting from the...

Its Investment Time in Bengaluru as Godrej Properties Presenting Premium Projects

Project ReviewsGodrej properties a name that has diversified the realm of Indian Real Estate and along with this...

Let’s Lock in Spiffing Projects in Mumbai for Long Term Benefits

Project ReviewsReal estate investment has always been a favorite and first choice of Indian investors because af...

Top of the Line 3 & 4 BHK Plush Apartments Range Available

Project ReviewsSelecting home for all is thrilling and extraordinary thing and after that shopping for a home is...

Vatika Group Ready to Buy Another Land in Gurgaon for Better Development

NewsVatika a well known reputed Gurgaon-based group is fetching 75 acres of land in Gurgaon against R...

Gurgaon is Undoubtedly a Top Investment Realm According to the Latest Survey

NewsAccording to the latest survey by Industry body PHDCCI Gurgaon is considered as the top-notch des...

Bestech Builder Presenting Class, Comfort and Luxury in its Top Creations

Project ReviewsHaving name is one thing and carrying vehement approach to continue it is another effort which is...

Office Space Still on The Top of the Race of Real Estate Investment

NewsThe residential properties might be somewhere lost but office spaces are in its right speed and t...

SARE Homes with Compelling Scheme in its two Leading Projects

NewsSluggish real estate market from the past 2-3 years have not shown much spark because of the endl...

Tata’s Remarkable Housing Options with Superlative Facets

Project Reviews“Tata” has been ruling the market through umpteen of products since its inception in 1868 under t...

ILD GSR Drive - Enjoy Impeccable Living Inside

Project ReviewsInternational Land Developers (ILD) is one of the leading names in the real estate industry which...

Exceptional Residing Option in Gurgaon by Raheja Developers

Project ReviewsThe real estate industry is bestowed with a plenty of residential projects by numerous of small a...

South of Gurgaon's Projects to Bring a Sea Change in the Development

Project ReviewsReal estate is a big realm where each one of us is connected or attached because it’s our foremos...

All You Wanted to Know about The Ravishing Properties

Project ReviewsResidential properties are the next big thing to dig up to meet up modern ambience, safety, highl...

Promient builders entering Noida for new investment land for all property buyers

NewsTata Housing prominent name in real estate realm after cherishing immense success in different ci...

The Bestech Group's Nonpareil Housing Development

Project ReviewsBestech builder with fervent approach and sterling mind-set has reached to the level of appreciat...

Notable Property Option to Consider in South Gurgaon

Project ReviewsWith the advent of prominent residential and commercial projects in South Gurgaon it has become t...

Gurgaon and South of Gurgaon Marked Out as a Smashing Investment Land

Project ReviewsWith ample existing decision there is one decision that is stated as an ‘audacious decision’ beca...

Top 5 Locations for Real Estate Investment in Gurgaon

Project ReviewsAs time goes by, Gurgaon also known as the millennium city is evolving as a major destination of ...

Investing in Real Estate for Retirement

Project ReviewsAccording to many statistics, the property values have quadrupled over past 70 years and accordin...

Gratis To Get Well Marked Plots and Plush Apartments, South Gurgaon

Project ReviewsToday South Gurgaon is considered to be the top notch destination for the face that it is a well ...

Foremost Precautions For Under Construction Home

Project ReviewsI have to say that this is something important and crucial to be considered for any newbie or sea...

Residential Properties with New Line Development to Change the Lifestyle

Project ReviewsAny place is vital when it has points or facilities to allure immensely, also real estate realm i...

Godrej Signature Homes - Presentation Lured me to Really Think about Future

Project ReviewsGodrej Properties a name that comes with trust, loyalty, perfection and satisfaction, with create...

Five Reasons Why You Should Grab Godrej's Homefest 2016

Project ReviewsIt is proffering a golden opportunity to the ones looking for an ideal abode or looking for a luc...

Godrej Home Fest 2016 - Enjoy 5 enticing offers

Project ReviewsGodrej Properties is a reputed builder in the real estate market and have completed its 5 years i...

Investment in Commercial Segment - Higher Growth Hacker

Project ReviewsIt is completely fair to say commercial investment is a lucrative way not just to control your ca...

Why Pataudi Road is an ideal Property Option?

Project ReviewsGurgaon is undoubtedly among the fastest growing cities that are in Delhi NCR. According to the s...

Office Space Still Leading with Major Benefits

NewsOffice space remains the most attractive asset in real estate market where investors and buyers a...

Canny Tips to King Hit Your Real Estate Business

Project ReviewsAfter such a long time I had an effective chinwag with one of the good friends and our conversati...

New Step to Re-Development Old Housing Societies in Different Areas

NewsNot enough swaying housing societies are about to re-shape to make them extra luxury and comforta...

New Rules to Boost Under Construction Projects

NewsNeedless to say, the new rules in real estate regulatory bill have created a genial approach for ...

Vipul Group - Presenting Hearty Housing Options to Change The Way of Living

Project ReviewsBoost your financial investment with the modern variety residential projects by supreme real esta...

Dwarka Expressway, Gurgaon with Promising Investment Housing Projects

Project ReviewsYour life is important and so as your decisions so heed to what you are doing?...

Why Dwarka Expressway is Alluring Immensely?

Project ReviewsThe robust infrastructures and amazing range of social infrastructures with the carte blanche to ...

5 Reasons Why You Should Invest and Enjoy Life in The Township

Project ReviewsIf there is any strong plan for investment in township this time, then there are top-notch leadin...

Godrej Home Rush 2016 - Concrete Deal as a Hobson's Choice

Project ReviewsThe demand of extortionate abodes and abodes that are for a song in the Delhi/NCR region is brewi...

Godrej Properties Covet Flexible Approval Process for Realty Projects

NewsNeedless to say, the approach of doing business has uplifted in almost last two years of NDA gove...

Best Residential Villas in North India Available with Trusted Features

Project ReviewsUndoubtedly, villas or apartments which is better, this is a ceaseless topic that never comes to ...

Kudos, Builders Attractive Strategies to Deliver their Projects

Project ReviewsCost going up faster than ever, bottleneck in approvals, sluggish market, mood swings and many mo...

Tata Housing Achievement, Sells Over 200 Flats in Gurgaon

NewsLeading realty firm Tata Housing again achieved a bigger target where they have sold more than 20...

Best Location Today with Leading Properties in Noida

Project ReviewsNoida – Greater Noida Expressway is one of the most desirable locations for real estate investmen...

Faridabad Real Estate A Big Investment Opportunity of NCR

Market TrendsFaridabad Real Estate is now booming with a range of positive changes thanks to the private & pub...

5 Signs That You Are Ready For Investment

Project ReviewsKnow these signs and understand whether you are ready for investment or not....

New Leading Trends to Enjoy in Our Next Home

Project ReviewsLife is good only when you have something to enjoy every day and home is that best space where yo...

Godrej Properties Another Victorious Development in Delhi NCR

NewsGodrej Properties, the real estate venture of the $4.1 billion conglomerate and the real estate a...

Rs 500, Rs 1,000 Currency Banned - Impact on Different Segments in India

NewsReal estate one of the prime realms where the heavy involvement of cash flow to avoid tax takes p...

Godrej Park Avenue, Prominent Address in Greater Noida

Project ReviewsLatest property in Greater Noida Godrej Park Avenue by Godrej Properties offering next level resi...

Demonetization Impact on Affordable Properties

Project ReviewsThe Real Estate market has come as a surprise with the hoarding of black money, reduction on inte...

Tata Housing Expanding, Enters in Noida with Lotus Greens

Project ReviewsAlready expanded name Tata Housing once again coming in the light of work where they are putting ...

Expected Luxury Home - Fall by 25-30%, Demonetisation Impact

User GuideThis unbeatable step by the Modi government for eliminating Rs 500 and Rs 1,000 has not only kick...

Utmost Important Requirements for taking Home Loan

User GuideIn this idyllic world, everybody have enough money for all his needs but in certainty, many of us...

Top 2017 properties setting new example for investment, grab it to grow it

Project ReviewsLet’s start with these two leading properties which have created indelible mark in the market, an...

Where to invest in Real Estate in India

Project ReviewsIndia is a very big term, let’s squeeze it and bring the top locations that has really created gr...

Top Location in India, Noida Sector 150 Starts Your Investment

Project ReviewsInvestment has had been a part and parcel step in many lives moreover; getting the right option i...

5 activities you should start from today onwards

User GuideLife is about a change and it is like part and parcel to have changes in life whether it is a tin...

2 exceptional properties with never seen features

Project ReviewsHome is that exceptional space that can’t be replaced with anything in this world. For example, y...

Quora best platform to boost any business every month

User GuideQuora, are you aware of it? Whether you are old or new to business it is important to sense what ...

Best Countries To Invest In Real Estate 2024

User GuideA rising trend has been seen in the global real estate market, that more & more people want to in...

Posh Area in Delhi: Check Out The Sterling Locations Of Capital City

User GuideDelhi has some luxurious houses in luxury locations due to its status as the capital city. With i...

POP Design For Bedroom: Give A Modern Pocket Friendly Look

User GuidePop Design For Bedroom - POP design is an excellent material to create elegant designs. It is an ...

Two Colour Combination For Living Room - Make The Best Choice For Yours

User GuideThe living room is considered the best corner to sit, laugh at, and enjoy moments of joy with fam...

4 mistakes if you are doing you are not the right investor

User GuideMistakes are made to learn out of it and if you do it you are on the right track. Keep all these ...

Top Cities for Investment in Real Estate in India? Highly Searched Question, Get it Right Here

Project ReviewsMainly, I got this question on Quora and I really liked it for the fact that investors and home b...

Top Innovations to Use in Your Home and Upgrade It

User GuideNeedless to say, everyone loves to have a home that speaks for them loudly about their taste and ...

Top 10 Luxury Apartments In Delhi: Delivering Lavishness To You

User GuideDevelopers are building some amazing housing communities across the country, especially in metrop...

Top Myths About Real Estate- Are They True or Not?

User GuideThis is an Insightful question. Real Estate is a complex subject and involves a lot of details re...

5 Must things to try this year

User GuideAre you not bored of that same common lifestyle? Obviously you are, then, what are you waiting fo...

Some Lesser Known Facts of RERA

NewsRERA (Real Estate Regulatory Agency) is all set to bring back your trust and faith in the real es...

It's Time to Take Care of Your Health! Easy Steps to Follow!

User GuideWe always look for easy steps to follow whether it is on health, investment, decision, innovation...

4 Real Factors Throwing Direct Impact on Your Website and Business

User GuideAny website is a showcase to your business and it is only conceptualized for your customers, so i...

How GST will Raise Indian Real Estate

NewsThe real estate industry from too long is waiting for the boom. It was in wait and watch mood tha...

Best Countries To Invest In Real Estate 2023

User GuideReal estate investment is a type of financial investment that includes any property or business w...

DLF Developer – Just Right Name to Invest in

Project ReviewsDLF Developer a reputed name in the real estate of India, their luxurious residential project bri...

Latest Lucrative Tips for Buying A House

User GuideThis unbeatable question “What are some lucrative tips for buying a house?” is something that nee...

Noida International Airport at Jewar Will Impact Real Estate Sector

NewsAs soon as the Jewar Airport opens, it will transform Noida and Greater Noida, as well as the hit...

Benefits of Investing In Residential Plots

User GuidePlots are a great choice of investment as it brings manifold benefits with itself. By spending le...

Domain Name Not Available Follow New Tips

User GuideSo to start your business you kick start your paper work, design your business card and decide wh...

Jewar Airport Gleaning Attention, Boost in Property Buying

NewsEvery destination has its important and that is obviously because of its pivotal developments tha...

Future of Indian Real Estate: Will It Shine In The Coming Years?

Market TrendsFuture of Indian Real Estate - The Indian Real Estate market has always come up with surprises. I...

100% Content, 100% Conversion

User GuideThis unbeatable topic 100% Content, 100% Conversion is like a latest fad among all who are into a...

Best Flooring For House: A Comprehensive Guide

User GuideTechnology is continuously evolving and presenting several developments out of which flooring is ...

Tips to Find the Best location to Live Your Lifestyle

User GuideThere are usually a few very good reasons that make a piece of land in one region worth more than...

Why Sohna Road is the Ideal Location for Investment?

Project ReviewsSohna Road, the rapidly growing part of NCR is witnessing prosperous growth because of number of ...

Top Reasons to Invest in Luxurious Properties in Delhi NCR

Project ReviewsLuxurious properties have always been in high demand and especially in Delhi NCR, which holds the...

Latest Properties in Gurgaon Beating New Trend in Real Estate

Project ReviewsGurgaon has many unknown benefits that you need to know, it is not that you were living under a r...

What are Some Important Facts to Know Before Investing in Real Estate?

User GuideI think any question is of no use until and unless you don’t get its perfect answer to justify it...

Leave Boring Lifestyle, Presenting Luxury Residential Properties to Buy Today

Project ReviewsGodrej Summit- Presenting you secured and exclusive home space with the combination of 2 BHK, 2.5...

Content Curator be Ready to Write With The Compelling Paragraphs

User GuideAre you good in making titles? Yes good, no it is bad, but life is all about learning and you can...

India's Famous Properties to Start Modern Life

Project ReviewsToday leading and top notch Indian Real Estate builders coming with its breathtaking housing segm...

Smart People Follow 5 Smart Tips, Make Your Every Day Better

User GuideSmart people will never follow common lifestyle and to make it nonpareil they always follow new a...

Turn Your Balcony into a Brand New Garden

User GuideHere will talk about the new and mother of creations that you can use in your balcony and create ...

You Need to Ask These 5 Questions Today

User GuideA biggest fallacy is we all feel that we are impeccable and make no mistakes, but the reality is ...

Noida Authority Sharp Twist in Rule to Deliver Property on Time

Project ReviewsAs you know there is a simple tenet that builder takes your money and then they work on their fin...

Durga Puja 5 New Ideas for Home

User GuideDurga travels in every home and filled it with 100 per cent joy and happiness because we are impo...

5 Tips to Make Your Blog Viral

User GuideUntil and unless, it is not having reasons to bring change, new study, a lesson, a tip or an inte...

With Work Out Follow 4 More Tips

User GuideYou might be doing regular work out, but when you are out with your friends or family you complet...

Top 4 Websites in Trend, Follow from Today

User GuideYou might be thinking it is an online shopping, i-phone or a sojourn to your dream destination th...

Manage Your Life in 24 Hours

User GuideIf you think you have 25 hours, then it is your biggest fallacy because all of us are having same...

This Diwali Go Creative with 10 New Ideas

User GuideThis year has reached to its end and everyone’s smile is an indication of the excitement of Diwal...

No Risk while You are Investing, Builder goes Bankrupt You will be Covered

User GuideGood news for all the home buyers. The Insolvency & Bankruptcy Board of India (IBBI) has added th...

Low Cost Homes Cynosure of All Eyes

User GuideNeedless to say, the requirement for home has reached to the new level and particularly home buye...

Eco Friendly House In India: Make Your Home Green With The Easy Tips

User GuideMany developers in India have come up with many different concepts for making a modern home, but ...

Gurgaon-Sohna Road - Enjoy Unlimited Opportunities Under One Roof

User GuideLocated in the southern part of Gurgaon, Sohna is also known as South Gurgaon. Various aspects of...

Gated Communities In India - Find The Luxurious Living Here

User GuideGated communities have become an imperative part of the country where every person is looking for...

Budget 2022 Highlights - The Whole Details At Glance

NewsBudget 2022 has come up with various tremendous steps that are very much required in making India...

Akshay Kumar House In Mumbai: Address, Price & Inside Images

User GuideHome to Bollywood's 'Khiladi', Akshay Kumar's house, is an ultra-luxury condo in the uber-luxury ...

Trends Influencing Luxury Housing Market In India

Market TrendsThe Indian luxury residential market has undergone a significant transformation over the last few...

Holiday Homes A Growing Trend In India !

User GuideHoliday Homes in India are again experiencing high demand from end-users & real estate investors....

Budget 2022: Real Estate Expects To Grow This Time

NewsThe real estate sector in India faced some challenges in 2020, but it bounced back strongly in 20...

A Complete Property Tax Guide for 2022 : Importance, Calculation and Online Payment

User GuideMany of us dream of owning a house or property, but we dislike all the additional responsibilitie...

Facebook AD Makes it Perfect with 7 New Tips

User GuideKudos to Mark Zuckerberg who launched “Facebook” in the year 2004 and till now it is running in a...

Only 1 year Deadline Addition to Real Estate Projects

NewsEverything has its end and if one is taking extra advantage of any leeway, then it is completely ...

Women Home Buyers Benefit in India !

User GuideWomen can also buy or acquire property and there are many initiatives are taken by government & l...

First time property in Gurgaon by Trump

NewsKeeping all the perks in mind, Trump Tower Gurgaon is surefire a big hit in Gurgaon as well as to...

Smart Properties in Gurgaon to change your Lifestyle Completely

Project ReviewsTop four properties in Gurgaon by the reputed builders leading in their own ways to provide a com...

Most Luxurious House In India - Check Out The Most Expensive Homes

User GuideThere are 138 billionaires in India who live in luxury homes and live lifestyles that are outrage...

Stay Happy Forever in Life by Using these 5 Tips

User GuideHappiness is beyond everything and there is nothing that can replace it, so stay happy with these...

NRI Investment Back in Indian Real Estate Market !

Market TrendsReal estate of India is booming and that is the reason why NRI real estate investors are investin...

A complete Investor’s Guide To Buying Commercial Property

User GuideCommercial Properties are the hit investment option bringing up multiple benefits. Here is the co...

It is Important to use your Time Effectively Before you Turn 30

User GuideBefore turning 30 it is important to use your time effectively and make the best use of availabil...

Trapped by the Wrong Builder, What to Do Now?

User GuideInvestment in property is an important step and if it is not taken seriously, then you may trap i...

Interesting things to do at Home with your Friends & Family

User GuideHome is the best place on this heaven and this time you can do your own interesting things at hom...

5 Properties Marked as the Best Properties of 2017

Project ReviewsTop properties of 2017 in India getting a lot of attention because of its amazing features that ...

Another Success in Sohna Gurgaon by the Leading Builder Godrej Properties

Project ReviewsLatest Godrej property on Sohna Road is getting all attention because this newly formed project c...

2018 Best Innovations to use at Home without Going Expensive

User GuideTop 5 Best home innovation in 2018 to use at home without going expensive. These tips you can use...

Which are the Best Residential Apartments in Gurgaon?

Project ReviewsBuying a home is the best desire and getting the best one is the most valuable thing, so here the...

In what Sectors is it Best to Live in Gurgaon?

Project ReviewsTop 4 sectors in Gurgaon presenting high level living by the prominent builders, here one can enj...

45% More Home Buyers are Looking for Smart Property After RERA

NewsRERA has shown positive impact on real estate sector and it has worked positively where it protec...

Best Ready to Move in Properties by the Promising Indian Builders

Project ReviewsUltimate ready to move in properties in Delhi NCR presenting exclusive lifestyle, get your own pr...

Godrej Properties offering Godrej Nature Plus, First Time Home Excessive Greenery

NewsGodrej Properties offering its smart green property Godrej Nature Plus in Sohna Gurgaon with 2 & ...

Ready to Move Property First Choice for Indians

NewsReady to move property remained the best form of property for Indians because there are many bene...

14 Tips To Turn Your Home Space Into Smart Space

User Guide2022 brings you the bag of opportunities and features to enhance the living space and turning the...

Which City In India Is Best For Real Estate Investment In 2022 ?

User GuideIf you are looking for real estate investment in 2022 but are in dilemma due to the current situa...

20% Reduction In Delhi Circle Rates Till June 2022 - Helping Move By The Government

NewsA good decision by the Delhi Government to curtail the circle rates in Delhi till June 2022 to he...

Indian Real Estate Market Forecast 2022

Market TrendsWhat are the chances of a housing market crash in 2022? Here are some developments and prediction...

Is Godrej Nature Plus a Good Investment?

Project ReviewsGodrej new project Sohna Godrej Nature Plus with 2 and 3 BHK apartments and good air quality ambi...

Real Estate Companies Plan To Invest Rs 18,900 Crore In Jammu And Kashmir

NewsAs the Union Territory opens up for residential and commercial development, real estate companies...

Real Estate Investment in 2018 - A Smart Idea

Market TrendsReal Estate Investment in 2018 is considered as the best year for investment because robust suppo...

Luxury Housing Uptick Expected To Continue In 2022

Market TrendsLuxury housing is one of the most eminent things humans crave for. It is everyone’s need now and ...

Godrej Properties Entering in Noida & Bengaluru with more Projects

NewsGodrej Properties Offering their New Projects in Noida & Bengaluru with Exceptional Amenities to ...

10 Home Trends Stealing The Spotlight In 2022

Market Trends2022 will bring manifold changes in everyone’s life so how the home can run with the old trends o...

DLF to sell Property Rs 15,000 Crore in 3-4 Years

NewsDLF LTD one of the leading builders in India planning to sell plethora of ready to move propertie...

What Homeowners Should Know About Solar Panels?

User GuideSolar Panel is one of the most effective ways of saving man-made electricity and using natural on...

Japanese Benemoth Sumitomo, Partnership with Indian Krishna Foray for New Development

Newskrisumi City waterfall Residences project in Gurgaon having all attention because this project is...

Smart Tips For Homeowners To Create Kid-Friendly Spaces

User GuideIn the midst of a pandemic, turning the old mundane home into a kid-friendly space is unique, and...

5 Amenities To Change Your Lifestyle Forever

User GuideDLF One Midtown in Moti Nagar Delhi is a new residential project presenting premium apartments wi...

Grand Luxurious Lifestyle in Delhi from DLF Developer

Project ReviewsMoti Nagar in Delhi is a locality with the best residential projects from DLF Developer, presenti...

Top 5 Tips in Negotiating for Your New Property

User GuideIf you’ve planned out to purchase a home in the coming year then check these facilities and servi...

Leading Properties in Sohna Gurgaon 2018 Buy your own Modern Homep

Project ReviewsTime to get a modern property in Sohna Gurgaon that connects directly to Delhi and Gurgaon. Leadi...

20 Q&A About DLF One Midtown Apartments In Moti Nagar

User GuideTo earn money, everyone works hard, but working hard alone is not enough; one also needs to work ...

Is Investing in Upcoming City Gurgaon a Good Investment Option?

Project ReviewsKrisumi Corporation presenting an international level home “Krisumi City Waterfall Residency” in ...

New Habits Women should Follow for Good Health

Project ReviewsImportant tips for women to apply everyday to keep their body, mind and soul happy forever. Healt...

Lock your Capital in the New 83 Metro Street Gurgaon

Project Reviews83 metro street Gurgaon is smartly situated in sector 83, Gurgaon. This is the best commercial pr...

Property Search Trends & Changing Market Dynamics In 2022

User GuideCovid-19 has brought several changes in the real estate market including the new norms of search ...

Interesting Residential Properties in Sohna Gurgaon

Project ReviewsLatest residential properties in sector 33 Sohna Gurgaon offering exclusive lifestyle, Book at at...

Most Beautiful Properties In The Market Today

Project ReviewsReal Estate is one of the most important sectors of a country that presents beautiful output. The...

IREO Developer to Deliver its 51 Storey Tower in Gurgaon

Project ReviewsIREO Developer presenting its ready to move property IREO Victory Valley in Gurgaon. Ready to mov...

How To Welcome New Year 2022 Amid Pandemic?

NewsPeople are already concerned about the celebration of New Year amid the rising cases of Omicron. ...

Latest High Level Residential Addresses by Godrej Properties

Project ReviewsGodrej Properties one of the leading builders in India is offering new range projects like Godrej...

Kalpataru Group Presenting New Project in Noida

Project ReviewsKalpataru Group offering new residential project Kalpataru Vista sector 128, Noida with 2 and 3 B...

Largest Commercial Project for High Business

Project ReviewsM3M India offering largest commercial project M3M Corner Walk Gurgaon in sector 74 mixture of ret...

Godrej Solitaire Nest Latest Project in Noida Getting Attention

Project ReviewsGodrej Properties offering Godrej Solitaire Nest residential project in sector 150 Noida. It is o...

Why Invest in Moti Nagar & DLF One Midtown?

Project ReviewsMoti Nagar in West Delhi is the best location and One Midtown is the best residential community f...

Unity Group Developing Heaven Home Address in Central Delhi

Project ReviewsUnity Group presenting residential project in Central Delhi Unity The Amaryllis Phase 2 offering ...

Best Properties in Delhi

Project ReviewsBest properties in Delhi, get flat, apartment and villas at ideal price. Types 1, 2 ,3 ,4 BHK apa...

Godrej Properties, What is Next They Offering?

Project ReviewsGodrej Properties offering new residential project Godrej Meridien Gurgaon in sector 106 offering...

Experion Developer Offering Heaven in Gurgaon

Project ReviewsExperion Heartsong Gurgaon in sector 108, Gurgaon offering new level residential project with 2, ...

Latest Properties in Gurgaon for Bigger Lifestyle

Project ReviewsLatest properties in Gurgaon by the leading builders DLF LTD, Sobha LTD, and Godrej Properties. B...

Ideal Indian Home by Hero Realty Private Limited in Gurgaon

Project ReviewsHero Realty Private Limited offering new property Hero Homes Gurgaon with 2 and 3 BHK apartments,...

DLF & GIC Invest Rs 1,250 Crore for New Housing in Central Delhi

NewsDLF coming up with new residential project DLF midtown Moti Nagar Delhi with Singapore’s sovereig...

Vatika Market Walk Latest Commercial Address in Gurgaon

Project ReviewsVatika Market Walk sector 82A, Gurgaon new commercial property offering food courts and retail sh...

Best Time Of Year To Real Estate Investment

User GuideIf you are looking for your dream home and want to get the best deals & countless options then re...

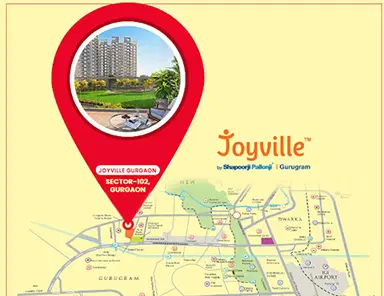

Joyville Gurgaon Introducing New Residential Project

Project ReviewsJoyville Gurgaon new residential property in Gurgaon offering perfect merge of 2 BHK, 2.5 BHK and...

A Best Opportunity to Invest in Delhi Real Estate?

User GuideIf you are looking for the best investment opportunity in Delhi Real Estate then DLF One Midtown...

Hot property of the year 2018- YOO Noida sector 150

Project ReviewsYOO Noida sector 150 Noida new residential property in sector 150, Noida offering 3 BHK apartment...

Godrej West Winds Lavish Address in Gurgaon

Project ReviewsGodrej West Winds sector 85 Gurgaon new residential project in Gurgaon offering ideal merge of 2,...

Hot Commercial Properties in Gurgaon with Assured Return

Project ReviewsGet the top commercial projects in Gurgaon with advanced business space. Hot commercial propertie...

Delhi Metro Phase 4 - Everything You Need To Know

NewsDelhi Metro Phase 4 with its third route of Tughlakabad to Aerocity is an under-construction phas...

Why Buy Hot Property in Noida? Godrej Nurture Noida New Property to Live More

Project ReviewsGodrej Properties presenting the new residential project Godrej Nurture Noida in sector 150 with ...

Local Transport Links in Delhi

User GuideIf you are new in Delhi and want to visit different attractions then it is very important to kno...

Latest Residential Project Godrej Air Gurgaon

Project ReviewsGodrej Air Gurgaon hot property in Gurgaon sector 85 offering 2, 3 and 4 BHK Apartments with high...

Do I Really Need A Real Estate Agent?

User GuideThe real estate agent is an imperative part of the real estate world. Without an agent crossing, ...

40 Questions to Ask When Buying a Home

User GuideBuying a home is not easy and it is normal to get a myriad of questions in your head. In this blo...

Hot Commercial Property in Gurugram to Grow More with M3M Broadway Gurgaon

Project ReviewsM3M Broadway Gurgaon hot commercial project with office space, retail shops and multiplexes studd...

5 Hot Residential Properties in 2019

Project ReviewsGet hot apartments in Gurgaon by the prominent builders in different locations in 2019. Latest fl...

Budget 2019 Curtailed the GST Rate on Affordable & Under Construction Homes

NewsNew GST rates in real estate for Affordable & Under construction homes now buy exclusive properti...

Important Factors That Will Affect Property Value

User GuideThere are lots of points that affect the property value, here in this blog we are disclosing some...

Once Again Gurugram Hot Investment Hub for Investors

Project ReviewsGurgaon is considered as the hot property investment place to experience prime lifestyle, attract...

Delhi Is The Best Place To Live: Reasons Are Mentioned Below

User GuideDelhi, being the capital of India is full of outstanding reasons making itself the best place to ...

The Step-By-Step Guide to Buying a House

User GuideBuying a home is neither nerve-wracking nor that simple. You need to be clear with all the points...

Latest Property in Mumbai, Northern Lights

Project ReviewsShapoorji Pallonji Northern Lights Pokhran Road 2 new hot residential space in Mumbai for bigger ...

Best Tips For Home Decoration.

User GuideHome decoration is the best way to keep living space full of energy, but you need a luxurious and...

Properties in Gurgaon

Project ReviewsHot properties in Gurgaon fetching high attention of home buyers. Buy hot flats in Gurgaon at app...

Which is the Latest Property in Gurugram?

Project ReviewsGodrej Habitat sector 3 Gurgaon new residential project offering 2 BHK, 3 BHK and 4 BHK apartment...

7 Important Tips To Check The Construction Quality Of The House

User GuideIf you are looking for your dream home in Delhi NCR, but don’t know how to check construction qua...

How to Choose the Right Old Age Home?

User GuideOld age homes are the latest buzz in real estate of India and have now become a standard even in ...

Why Reputed Brands In Real Estate Are Better?

User GuideDelhi NCR real estate is full of real estate developers many of them are local developers and onl...

How To Save Money When Buying A Home? Know Everything In Detail

User GuideHome buying can look like a daunting task initially because of the huge amount of money involved ...

Best Place To Live in Gurgaon For Family

User GuideIf you want to buy a residential property in Gurgaon then there are lots of options, but here we ...

Adani Samsara Vilasa, New Residential Hub for Bigger Stay

Project ReviewsAdani Samsara Vilasa latest residential property in Gurgaon sector 63 offering 3 BHK independent ...

Gurgaon Is Coming Up With New Constructions In Independent Floors

NewsGurgaon is coming up with new independent floors constructions in different size and location by ...

2019 Hot Residential Properties For a New Change

Project ReviewsNew properties India in different locations 2019 is offering high updated modern services and new...

Sector 27 Gurgaon Getting Huge Attraction! Know The Reasons Below

User GuideGurgaon is an extensive industrial and financial hub. Infrastructure expansion, accelerated urban...

New Property in Delhi, Godrej Platinum Okhla for Bigger Stay

Project ReviewsGodrej Platinum Okhla New Delhi hot residential property offering 2 BHK , 3 BHK and 4 BHK apartme...

A Surge in the Demand of Independent Floors

User GuideSeveral benefits of independent floors make them highly sought after. Over the last few years, in...

Enjoy The Lucrative Benefits Of Independent Floors Living

User GuideIndependent floors are the demand of today’s living because of the ultimate luxury and privacy it...

High Tech Security Systems First Pick of Home Buyers

Project ReviewsAdvanced security system in the new residential properties Delhi, Gurgaon and Noida offers a secu...

Gurgaon Is Facing A Phenomenal Hike In Demand Of Independent Floors

User GuideDemand for independent floors in Gurgaon is increasing because of the interest of investors and b...

Dwarka Expressway Gurgaon Real Estate Booming, know Some Facts

Project ReviewsDwarka Expressway is considered as one of hot upcoming locations for property investment with bi...

5 Reasons Why Dwarka Expressway New Property Takes Attention?

Project ReviewsDwarka Expressway Gurgaon hot location offering new residential project Joyville Gurgaon Sector 1...

Why Goa Property Investment Turns out to be a Big Benefit ?

Project ReviewsGoa one of the best tourist locations opening high tourism and real estate market. Goa property i...

5 Exclusive Reasons that Make New Property Gurgaon "Marvy"

Project ReviewsConscient Hines Elevate Gurgaon latest residential property near Golf Course Extension road offer...

Conscient & Hines Together to Elevate Residential Project in Gurgaon

NewsConscient Hines Elevate latest residential development in Gurgaon presenting hot property with u...

What should I look for when Investing in Real Estate?

User GuideProperty investment takes more attention so better to look at the factors to be considered before...

Is It Your First Time? Here Is Our Best Home Buying Tips!

User GuideBuying residential property is one of the biggest investment. And, that's why it is very necessar...

Property Prices ‘Drop Down’ in the Major Indian Cities

Market TrendsPrices of properties are falling because of the sluggish market and affordable projects are gaini...

3 Reasons, Luxury Property Getting All Attention, Return of NRI's

NewsGood time to invest in India and NRI’s can get the best result out of it, so you can find the hig...

7 Reasons Real Estate Investment Profitable in 2019 And Further

Market TrendsReal estate investment considered as the best option for novice home buyers and investors because...

Circle Rates of Commercial and Residential Properties Slashed in Noida

NewsIf you are looking for investment in Noida real estate and waiting for the right time then this n...

Buyers Will Not Hold For Possession, Get Refund Immediately

User GuideBuyers can buy property with the RERA benefits in any state and also provides refund if the build...

Delhi No More a Place to Live in, Green Property is the only Aspiration

Project ReviewsDelhi air quality index has reached to its worst level where it is essential to control the pollu...

15-25% Rise in Sales During and After Diwali: Real Estate Sector

News15-25% rise in sales during and after Diwali, real estate market the first preference for the cus...

27% Unsold Inventories in Noida & Gr. Noida Curtailed

News27 per properties are now sold out in Noida and Greater around the festive season. Builders servi...

Rs 1500 cr investment by the DLF LTD For New Commercial Project

NewsDLF ltd working on the new commercial project in Gurgaon to add the best commercial address servi...

Green Homes in India

User GuideGreen property is fetching good attention to live healthy and active life....

Municipal Corporation of Gurgaon (MCG) Property Tax Can Now Be Paid Online

NewsMunicipal Corporation of Gurgaon (MCG) has initiated the online processing of property Tax. It is...

Its Christmas, It is Time To Celebrate with a Lucrative Decision

NewsBuy property this Christmas and get high discount, modern property and a new house for your famil...

Mini Theatre & Hi-Fi Salon Service in the Godrej Prive Gurgaon by Godrej Properties

Project ReviewsNew housing project in Gurgaon by Godrej Properties Godrej Prive Gurgaon Dwarka Expressway offeri...

In COVID 19 Real Estate Demand Continues

NewsReal estate demand in India still continues in Covid-19 builders are offering impressive discount...

Difference Between Rural and Urban Living

User GuideRural and Urban both livings are important at their own place, but each has lots of difference an...

What Is HRERA? A Must-Know Guide for Home Buyers

User GuideHRERA has come as an opportunity for all the developers and buyers by maintaining a healthy relat...

Want to Buying a House in Gurgaon? - 10 Steps

NewsBy following 10 steps they can make their home buying experience untroublesome and make the best ...

How Digital Market is Overcoming the Traditional Market of Real Estate?

Market TrendsReal estate is undergoing a progressive shift from traditional to digital markets. Digital market...

Top Residential Areas To Invest In Gurgaon 2021-2022

User GuideInvestment in the residential project is one of the best decisions and that is why most investors...

Real Estate Market Challenges And Opportunities In 2021

Newswe talk about Delhi NCR, then there are lots of residential properties which were unsold but read...

Model Tenancy Act 2021? Know Your Rights And Duties As Tenant Or Owner

NewsThe Union Cabinet, chaired by the Prime Minister of India, on 2 June 2021 has approved the Model ...

Best Way To Look For A Home - Online Or In-person?

NewsIf you are looking for contemporary and luxurious residential apartments in Gurgaon, you can chec...

Things To Look Out For When Viewing A Property

User GuideGoing for a site visit but don’t know what to look for in your dream home, don’t worry here we ha...

What Is The Debt To Income Ratio In Home Loans And Why Should You Care?

NewsIf everything is fine then the Debt-To-Income ratio could be your weak point. This factor just li...

Urban Growth or Urbanization - What We Actually Need?

NewsAs our country boards on a new platform of swift development in the coming years on the way towar...

Rights of A Tenant in India

User GuideIf you are living in a rented apartment then it is very important to know about your rights. Read...

Honest Conversation With Happy Customer of DLF Crest

NewsBuying a home is an opportunity but a luxury home in Gurgaon is a once-in-a-lifetime opportunity ...

Build Multi-Generational Wealth With Real Estate Investment

User GuideReal Estate in India is not only an investment option but the best way to build multi-generationa...

Why High-Rise Apartments In Mumbai Are Expensive And Cheap In Delhi?

User GuideHigh-rise apartments for Mumbaikar and low-rise apartments for Delhiite are the preferred choice,...

Delhi Metro Phase 4 - A Much Required Boost For Connectivity & Real Estate of Delhi

NewsRecently the Central Government has finally granted its approval to the Delhi Metro Phase 4, incl...

Office Absorption: Noida Ahead of Gurugram

NewsThe real estate market of Noida has maintained the top ranking in the 4 following quarters as the...

What Are The Advance Payments Comes With Home Buying?

User GuideThere are different type of mandatory advance payments comes with home buying, but as a home buye...

Secure Your Investment by Choosing a Branded Developer

NewsBuying a dream home is one of the biggest decisions which need to verify lots of points. The sele...

Construction Technologies Are Shaping The Future of Real Estate

NewsWe live in a technology-driven world; every aspect of our day-to-day living has more or less invo...

Biggest Reasons Behind Recovery of Indian Real Estate And Future Expectations

NewsThe Real Estate Sector of India is now on the right track with a speedy recovery, there are lots ...

Cryptocurrency in India and Its Effect on the Economy

NewsHow cryptocurrencies will help the Indian economy to boom? Why real estate sector should adopt cr...

How 4 BHK Home Can Add Extra Comfort To Your Lifestyle

NewsChoosing the best one from countless options can be a very tiresome task and the same thing happe...

Mahesh Babu House in Jubilee Hills Hyderabad: Address, Price & Inside Images

User GuideTollywood superstar Mahesh Babu maintains a luxury home in Bangalore, a spacious & expensive prop...

Why Investment in Bahadurgarh is a smart choice?

NewsBahadurgarh is strategically located nearby Delhi, with the Delhi - Rohtak corridor and Brigadier...

What Is Mivan Technology: Know About It In Details

User GuideMivan technology is a rising construction technology that leaving behind the conventional ways of...

How you can reach Joyville Gurgaon Sector 102? Routes from Delhi, Noida and Faridabad

User GuideShapoorji Pallonji Real Estate introduces Joyville Gurgaon, Gurgaon's best residential project. H...

5 Benefits of Buying Property At A Young Age

User GuideReal estate investment at young age teaches the actual difference between investments and saving....

What Home Buyers Are Looking For - Fully Furnished, Semi-Furnished or Unfurnished?

User GuideAs per the data of real estate experts, regardless of the observable advantages of a furnished ho...

Ready To Move Affordable Flats in Gurgaon

User GuideThe real estate of India is one of the fast-developing and most recognized sectors. Generally, it...

Real Estate Sector Fully Prepared To Fight With Third Covid, Let’s Find Out How?

NewsIt’s been just a month that the real estate sector of India has emerged from the second wave of t...

Interior Design Aspects You Should Keep in Mind When Buying a Home

NewsWhy is it that some home seekers can easily see the actual potential in a home, while no one else...

Rental Market In India Expected To Boom Over The Next 2 Years. Are You Ready?

NewsIndia’s expectation for rental real estate is at its peak, with widespread urbanization countrywi...

Health Hacks To Keep Your Home Monsoon-Ready

NewsEvery residential community from these developers like Joyville Gurgaon, DLF Ultima, Tata Primant...

Real Estate Looks Ahead To Bright Future With Relief, Adaption, and Flexibility!

Market TrendsThe real estate of India covers approx 8% GDP of the country, 4 years back the residential proper...

Take Advantage of 74% off on Stamp Duty, Seal Your Deal with Tata Housing!

NewsTata Housing on the completion of 74 years of Independence has announced a “Happy 74” offer for t...

Is Gurgaon an Ideal Investment Destination?

Market TrendsGurgaon real estate is one of the best choices for real estate investors in terms of ROI. This re...

How to turn your ordinary home into a smart home?

User GuideThe only way to turn your ordinary home into a smart home is to buy lots of components like senso...

12 Reasons To Move Into Tata Eureka Park!

Project ReviewsTata Eureka Park is the best residential project in Noida Sector 150 from the reputed developer T...

Searching For A New Home In Lockdown? These Tips Can Help You

NewsThe impact of the coronavirus has been felt globally and real estate has got a major blow. Many h...

5 Ways To Stay Within Budget While Buying Residential Property

User GuideLimited Budget is one of the main concerns of home buyers these days, if you are one of them then...

How do we use Smart Home Technology in Hightown Residences?

Project ReviewsSmart home technology is the commonly used term for the high-tech home amenities fitted with comm...

Cost of Living in Delhi NCR For Working Class!

NewsResidential properties in Delhi NCR are available at a very wide price range depends on the local...

The Best Fine-Dining Restaurants Nearby Tata Eureka Park Noida!

Project ReviewsNo matter, you are coffee lovers, continental or spicy food lovers, and what’s not; here we have ...

Is Affordable Housing A Good Investment In Gurgaon?

User GuideReal estate investments are the best way to earn a good return on capital and with affordable pro...

Top 10 City View Apartments in Noida

Market TrendsWhen it comes to buying a dream home, high-rise city view apartments are the most sought-after th...

A Perfect Guide Before Buying ready-to-move-in Apartment in NCR

User GuideHome-buyers in Delhi NCR generally end up making lots of changes to their new home to make it fit...

Why Home Automation System Is A Must-have Feature In A Dream Home?

NewsBuying a smart home in Tata Eureka Park Noida will make these and much more, a reality. ...

Why Should Invest in Tata Eureka Park?

NewsTata Eureka Park in Noida Sector 150 emerged as the most sought-after investment opportunity that...

Property Market In Delhi-NCR: 2021-22 Will Be A Great Year, Here Is Why

NewsBuy your dream home or wait for some more time. Want to get rid of living in rented home under th...

Changes in Homebuyers' Behavior After the New Normal

Market TrendsThe home buying process during the new normal has considerably changed. Now, people are trying to...

Work From Home in Covid-19 Times- A Great Opportunity for Real Estate to Bloom

NewsPandemic has crippled everyone’s mind. It has affected everyone in a dire way...

Top Security System for Your Home in 2021

User GuideTo be able to hope to stop such crimes from occurring at your house, you should consider installi...

Best Options For Real Estate Investment In India

User GuideFor a long time real estate has been considered a very beneficial & fruitful investment model. Th...

Residential Properties Nearby Golf Course A Smart Investment Opportunity!

Market TrendsIf you are a golf lover, then you will love living nearby a golf course where you can play this s...

What Do You Need To Buy A House For The First Time?

User GuideNow you are ready to take one of the biggest investment decisions in your life – buying your drea...

Surprising Facts About Gurgaon Real Estate!

NewsThe Gurgaon real estate market can be a surprising place at times, with home buyers paying more t...

How IoT Is Changing The Real Estate World?

Market TrendsMornings are different now. We can move more conveniently in life and a lot has changed in a coup...

6 Ways To Get More Rental Applications For Your Apartment in Delhi

User GuideThe best way to get more rental applications for your apartment in a big city like Delhi is to ha...

Top Localities in Gurgaon Perfect for Renting

NewsDLF are considered to be the best regions in Gurgaon. These phases have everything that you need ...

Current Indian Real Estate Industry - What’s in and out of it?

NewsIndian real estate developers have shifted their gears and are ready to accept all the challenges...

If Covid19 Keeping Your Passport away - Goa is best for travel & real estate investment

Project ReviewsTravel abroad or planning for real estate investment out of India seems like a faraway dream, 202...

A Day in Sobha City Gurgaon!

User GuideIf you still want to know in detail, let us walk you through the best things you may enjoy doing ...

Nature, Modernity, Investment: Why Goa Should Be Your Future Home!

User GuideTata Rio De Goa in Dabolim South Goa is Tata Housing's first residential project in Goa that aims...

Smart Gated Communities An Ideal Choice For Senior Citizens

User GuideSmart gated communities like Tata Eureka Park in Noida emphasize the significance of safety, and ...

Where to Invest Property in Delhi NCR? Noida, Faridabad, or Gurgaon!

User GuideFor investment Delhi NCR, is the best option and the easiest way to gather higher return over inv...

Best Time To Buy A Dream Home In Gurgaon Despite Pandemic

User GuideStarting of the year 2021 was very bad in comparison to the year 2020, due to the second wave of ...