Indian real estate developers have shifted their gears and are ready to accept all the challenges to improve the market condition. They are strengthening their teams by organizing and hiring qualified professionals that augment the manpower condition in architecture, engineering, management, and more.

Indian real estate market is one of the most globally accepted sectors that comprise of four sectors housing, retail, hospitality, and commercial. The growth of this sector is incontestably miraculous no matter what the situation is!

People in the real estate sector have bright outlook from it, and they invest without any shilly-shallying because it is the second-highest employment generator in India.

| Current state of housing in India |

Requirements to achieve the vision by 2022 |

| Size crore housing units shortage |

India needs to develop 11 crore housing units |

| Annual investment in the housing sector is about USD 110 to 120 billion. |

Investments more than USD2 trillion or about USD260 billion annual investment till 2022 |

| Average growth of 5-6% in annual real estate sector between FY08 and FY14 |

Investments need the growth of 12-13% in 2022 |

| Uneven housing distribution as prioritizing just on rural growth |

Approximately 70% of housing needs in nine states by 2022 |

Why is investing in Indian real estate advantageous?

Robust demands

- Real estate demand for data centers is expected to increase by 15-18 million sq. ft. by 2025, according to Savills India.

- India requires 11 crore housing units on a pan India basis by 222 to achieve this target of PMAY.

- People just want lucrative returns in the future and that investment today is important.

- Approximately 25 million units are needed of affordable housing to meet the growth and shortage of the country’s urban population housing.

Attractive opportunities

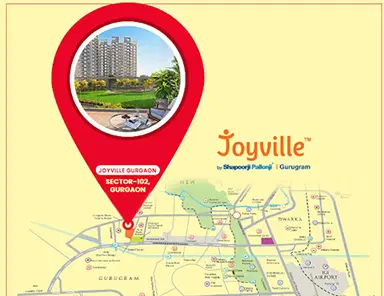

- Neeraj Bansal- Head of Real Estate and construction of KPMG in India - Decoding housing for all by 2022. The central government is pushing the residential sector by taking some initiatives like the Pradhan Mantri Awas Yojana (PMAY) scheme of the Union Ministry of Housing and Urban affairs. The govt. is aiming to build 10 million affordable houses in urban areas.

- The demographic trend shows that India is at the peak of large-scale urbanization and over one crore population is going to add to urban areas by 2050.

Predictions coming up for real estate market growth

- Size of real estate market will reach $1 trillion by 2030- Ketan Sengupta, CEO, Bengal Peerless Housing Development Company (BPHDC). The Indian real estate market has witnessed a slowdown amid the pandemic but kudos to the realty players who are coming up with tremendous projects with the expectations of improving the market soon.

- IBEF-India Brand Equity Foundation- By 2040, real estate market will grow to Rs 65,000 crore ($9.30 billion) from Rs 12,000 crore ($ 1.72 billion) in 2019. The real estate sector in India is predictable to reach a market size of $1 trillion by 2030 from $120 billion in 2017 and supply 13%to the country’s GDP by 2025.

- The retail real estate and warehousing segment attracted private equity (PE) investments of US$ 220 million and US$ 971 million, respectively, in 2020. Grade-A office space absorption is expected to cross 700 MSF by 2022, with Delhi-NCR contributing the most to this demand.

- Anarock, a property consultant said that India is going to have 100 new malls by 2022 of which 69 will be in the top seven metropolitan cities and the remaining 31 in tier 2 & 3 cities.

- According to the Economic Times Housing Finance Summit, about 3 houses are built per 1,000 people per year compared with the required construction rate of five houses per 1,000 populations. The current shortage of housing in urban areas is estimated to be ~10 million units. An additional 25 million units of affordable housing are required by 2030 to meet the growth in the country’s urban population.

- Aditya Kushwaha, CEO and director of Axis Ecorp also said that government should accord industry status to real estate as a whole. Housing loan interest rates need to be reduced to boost demand and sales.

Developments took place

Needless to say, Indian real estate has witnessed amazing growth. A rise has been observed in the residential spaces and office space as well. Indian real estate attracted $5 billion in institutional investments in 2020.

The sector attracted private equity investments worth Rs. 23,946 crore (US$ 3,241 million) across 19 deals in Q4 FY21.homebuyers took the advantage of low mortgage rates and the incentives rendered by developers.

Boost to real estate according to the current union budget

- To promote affordable housing for migrant workers, Sitharaman proposed to allow tax exemption for notified affordable rental housing projects

- Debt financing of InVITs and REITs by Foreign Portfolio investors will be enabled by making suitable amendments in relevant legislations. This will help in augmenting the funds for infrastructure and real estate sectors.

Road ahead

The REIT platform allows investors of varied backgrounds to invest in the Indian property market, and SEBI- Securities and Exchange Board of India has given its approval on it. This will help to improve the market worth by Rs. 1.23 trillion in the coming years.

Indian real estate developers have shifted their gears and are ready to accept all the challenges to improve the market condition. They are strengthening their teams by organizing and hiring qualified professionals that augment the manpower condition in architecture, engineering, management, and more. This gives a ray of hope of significant growth of the residential sector and meets the ever-increasing demand of the commercial, residential and retail spaces.